2022 Healthcare

Prognosis

When we published our survey results in 2021, vaccines had yet to be broadly released, Tiger Global was still a growth investor and SPACs were en vogue (at least the raising part…). 2021 respondents overwhelmingly correctly predicted a booster would be available before vaccine protection waned, SPACs would return to being a niche product, and that a return to office would include a hybrid approach. However, the Delta and Omicron variants threw a curveball at us and subsequently forced mask mandates back into effect. Covid continues to be unsettling with BA.2 now taking hold and resulting in Philadelphia reinstating an indoor mask mandate on April 11, 2022.

Three months into 2022, the world seems even more unpredictable. While Covid cases have fallen in most of the world from Omicron peaks, there are worrisome signs in China and a giant reservoir of unvaccinated people which could give rise to more variants. Russian aggression and hostilities understandably are top of mind given the worldwide human, economic and political ramifications. Once again, we asked our network of experts for their opinions on the latest trends in health tech, world issues, and the outlook for Covid-19.

Below is our commentary on the most interesting findings from this year’s survey, followed by the full results.

I. OUTLOOK FOR COVID-19

Vaccines and boosters have dramatically reduced the morbidity and mortality associated with Covid-19. Two years into the pandemic, we’re smarter and better equipped to deal with the virus, however, as we saw with Omicron, things can change on a dime and likely will again.

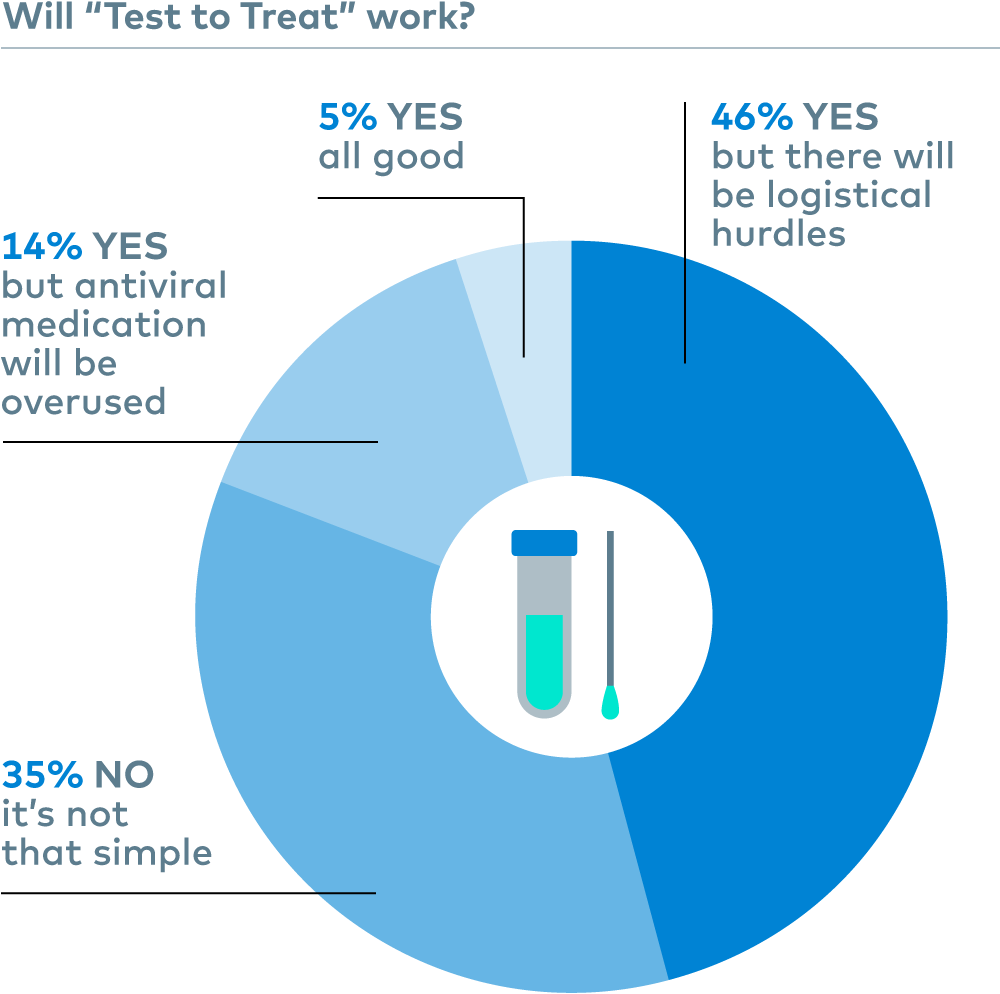

“TEST TO TREAT” - EASIER SAID THAN DONE

Many of you think that "Test to Treat" could work in theory, but only 5% believe we won’t botch it in some manner or another.

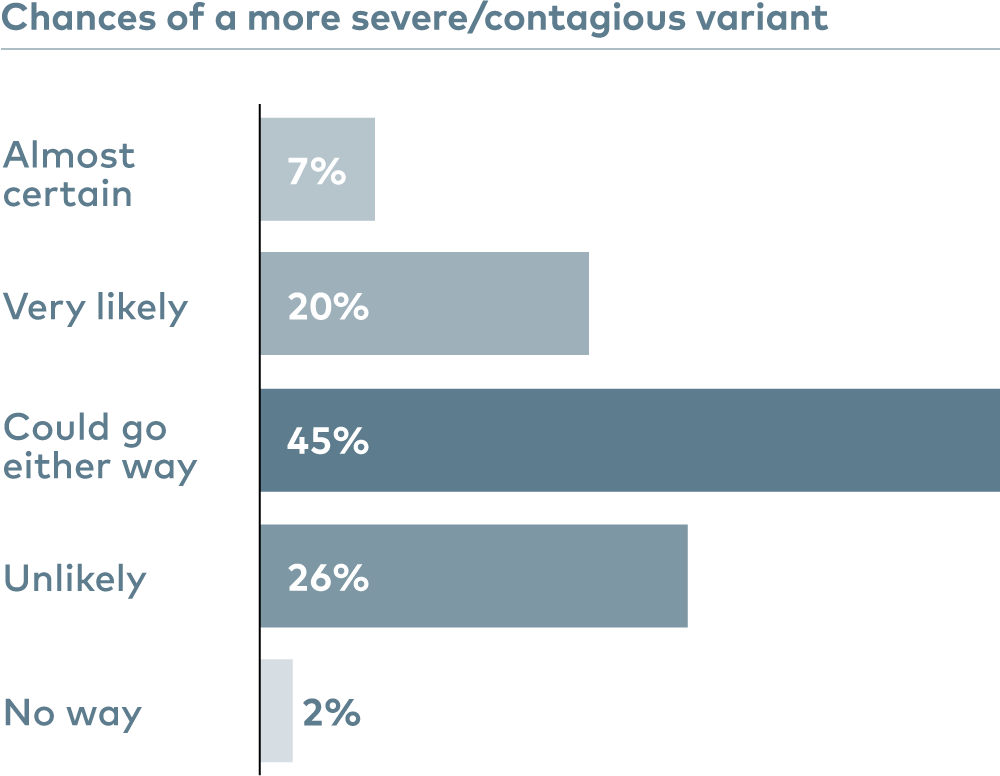

VARIANTS AND VARIANTS

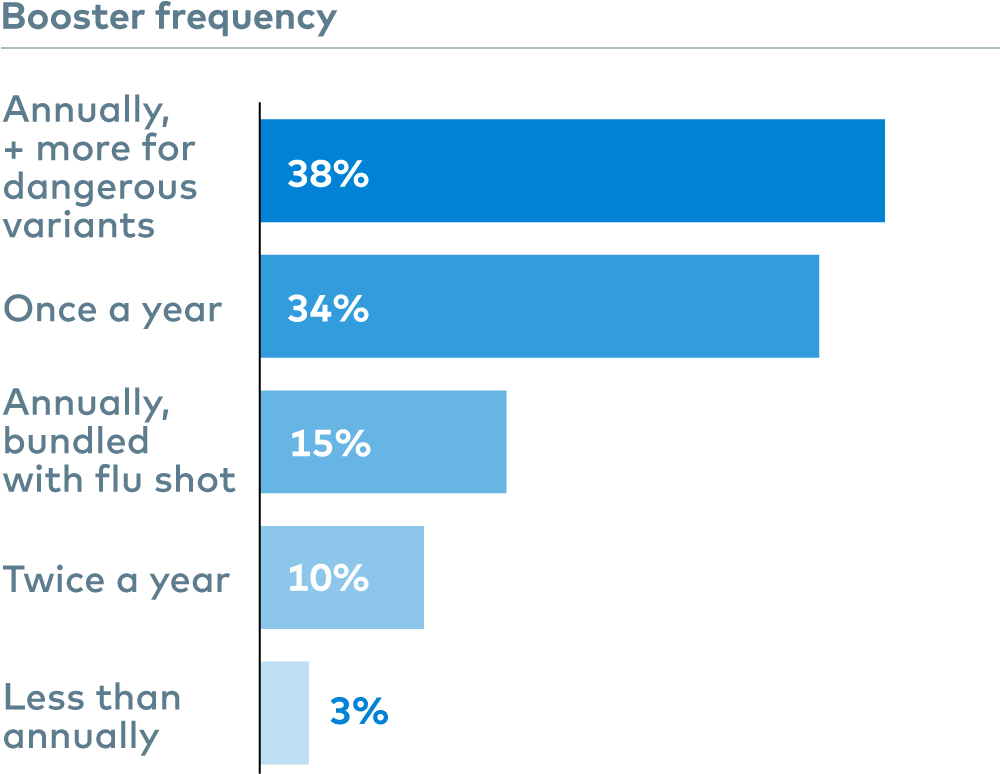

Wisdom of the crowd says it’s anyone’s guess if we will see a more serious variant in the future, though in-house we are firmly in the 27% camp of “Very likely” - “Almost certain”. When asked about vaccine frequency, 90% of people felt annually was the eventual cadence for vaccines with a large subset (38%) expecting additional boosters for dangerous variants.

II. HEALTH TECH ENVIRONMENT

Continued maturing of the industry and behavior changes fueled by Covid-19 drove funding in health tech to nearly $30B in 2021. Respondents were asked to weigh in on various aspects of the current environment in health tech, including funding and exits.

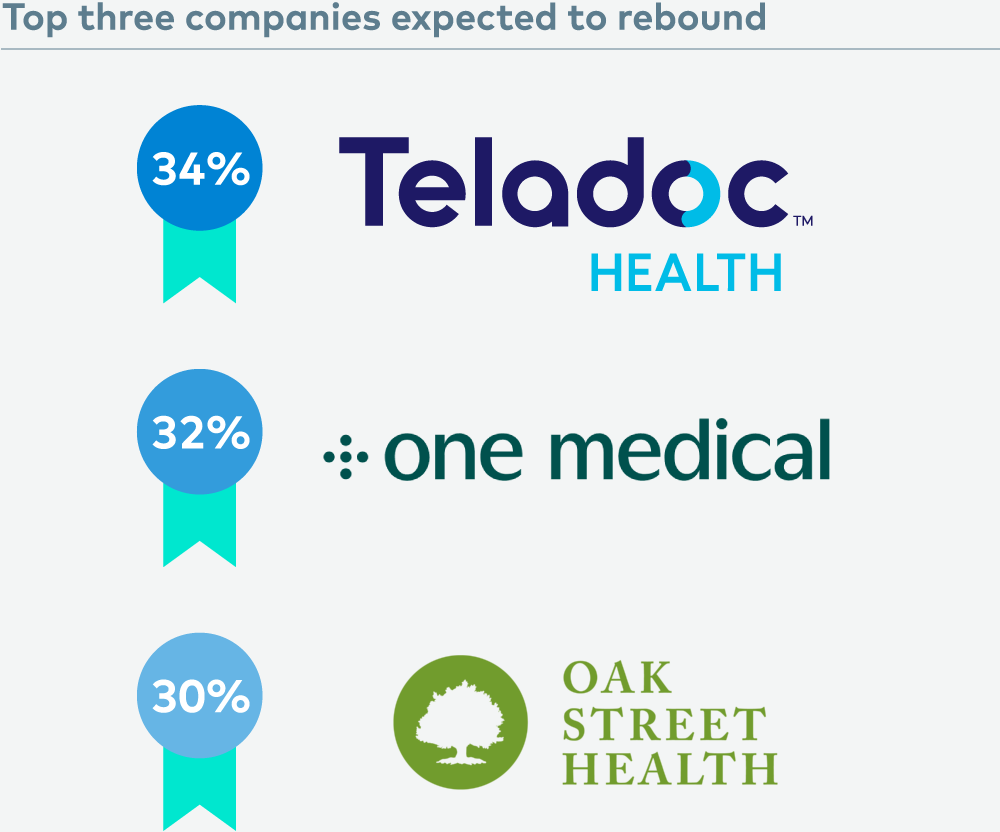

BETTING ON FALLEN ANGELS

Recent health tech IPOs have seen their valuations crash as much as 90%, but which are poised to rebound? Respondents were bullish on primary care and not much else…

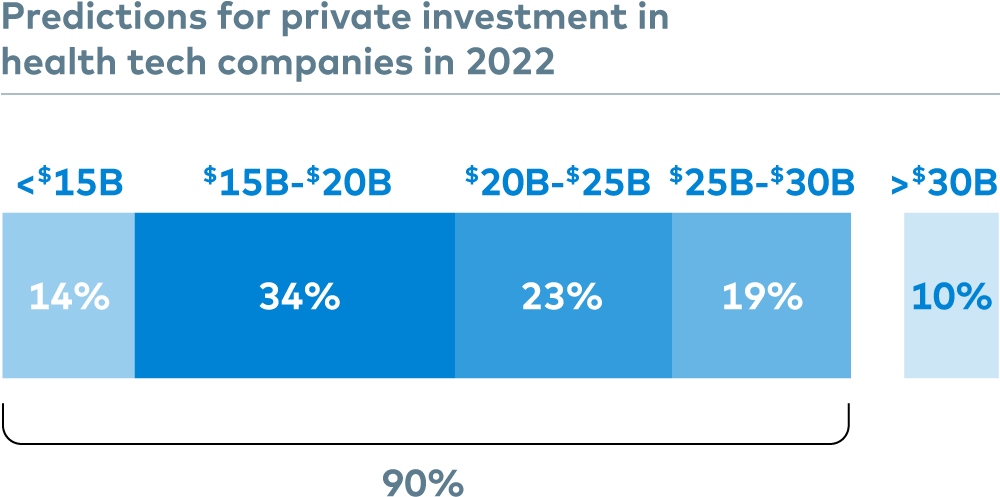

HEALTH TECH INVESTMENTS COOLING OFF

Private funding of health tech companies has tripled since 2019 (to $29.1B in 2021), but 90% of our pundits expect 2022 to be a decrease with 50% of respondents predicting a dramatic (>30%) fall in funding.

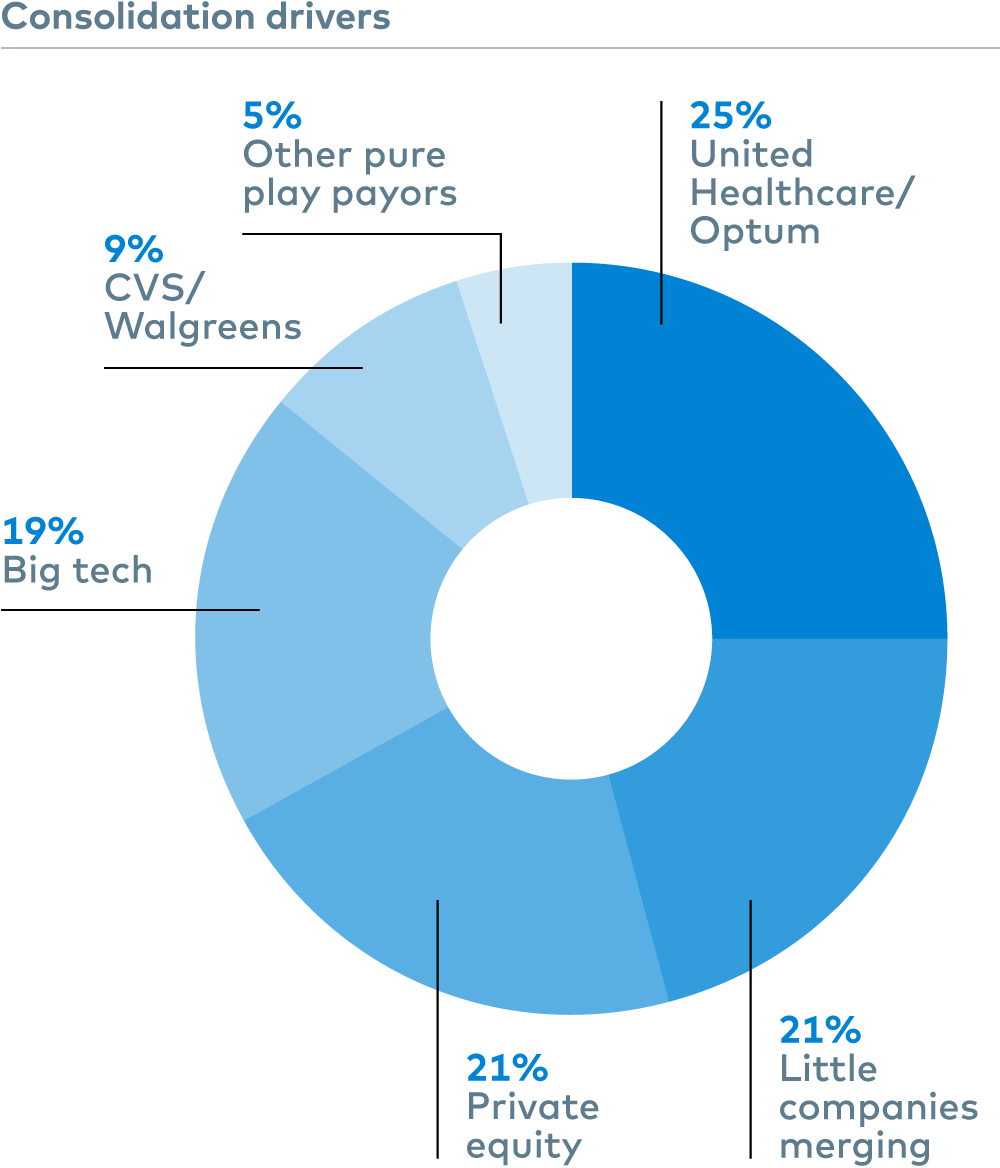

EXIT?

SPAC, we hardly knew ye… After correctly predicting that SPACs were likely to return to a niche approach last year, respondents were asked if the closing IPO window would open the door for SPACs to take higher quality companies public this year. Respondents were also asked about potential acquirers to fuel consolidation and picked their favorites among the health tech companies expected to IPO this year, with one in six feeling bearish enough to predict a total closure of the IPO market.

III. POLITICS AND JUSTICE

As we continue to navigate seemingly intransigent parochial issues, Russia’s invasion of Ukraine dramatically changed the stakes. We went from being a country divided (and included in the Boris Johnson, Silvio Berlusconi joke memes) to a deeply scary, uncertain and endangered world.

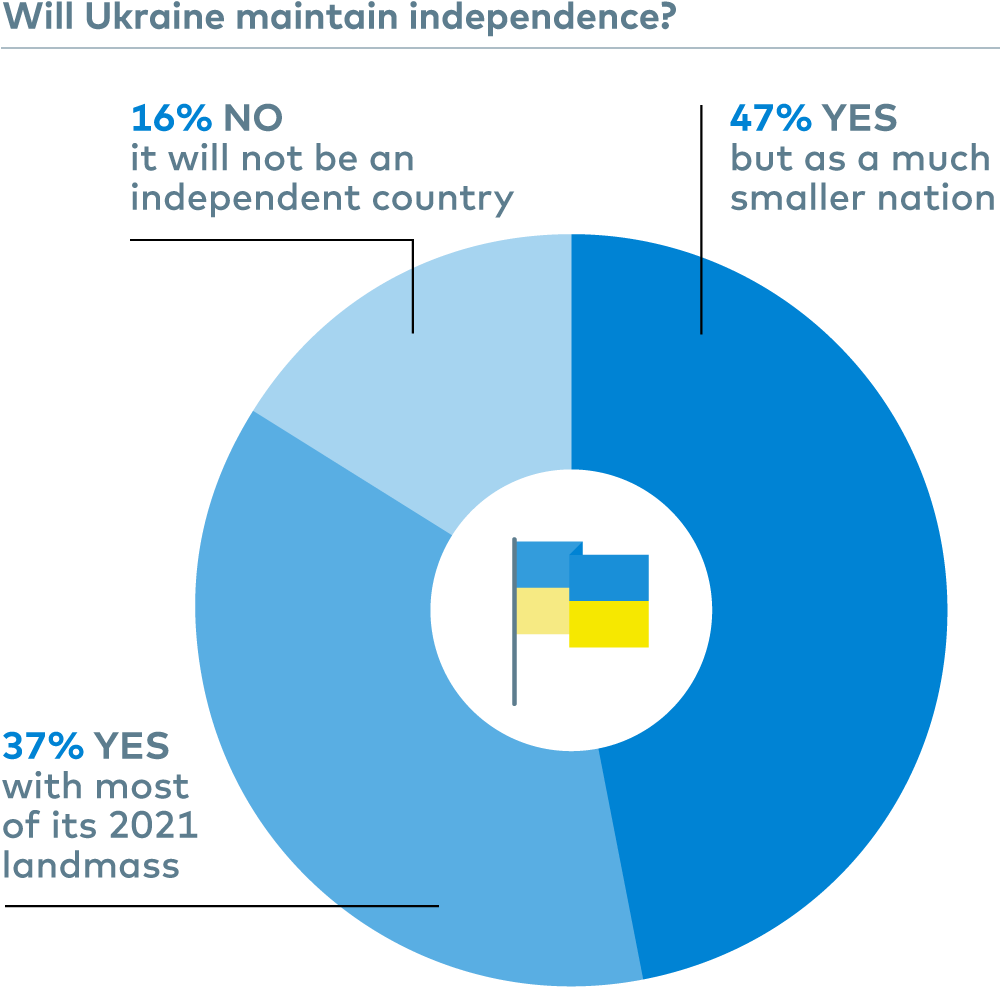

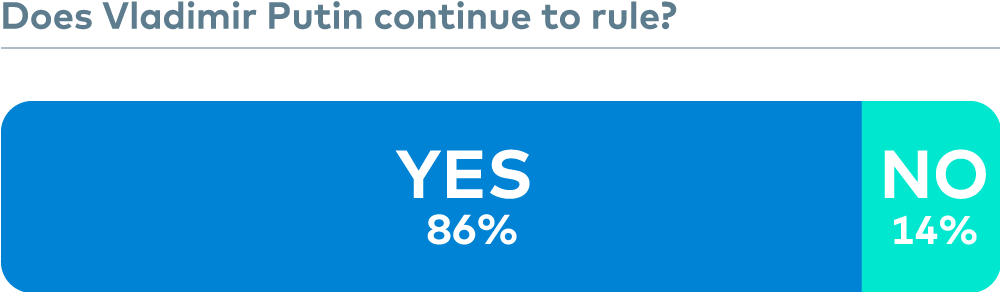

UKRAINE AND RUSSIA

The vast majority of respondents anticipate Putin will remain in power and Ukraine will remain an independent country, albeit possibly much smaller. While we unfortunately agree with the Putin prediction, we are rooting for the underdog...

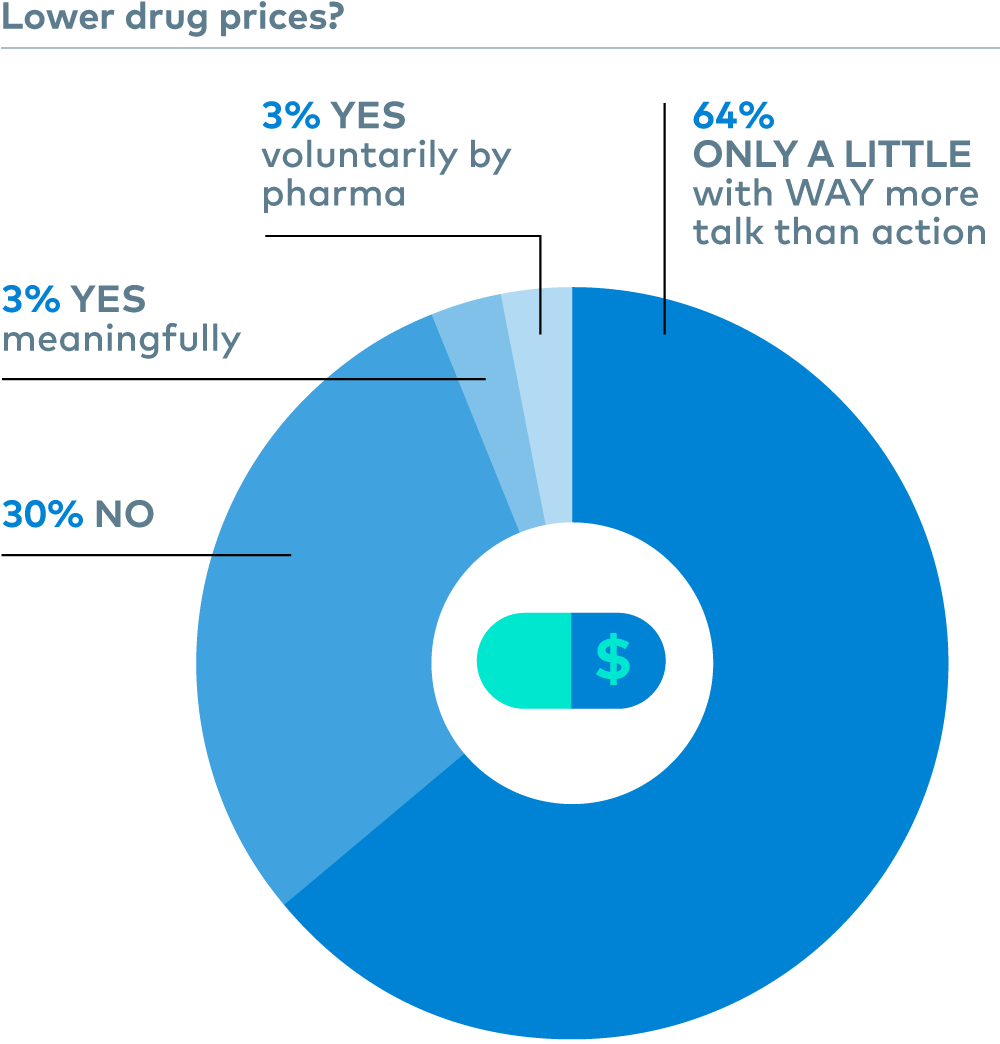

DRUG PRICING SAME OL' SAME OL'

While President Biden committed to lowering drug prices in his State of the Union speech, this is our evergreen prediction: nothing is going to happen with drug pricing. Even worse than 2 years ago when 15% said yes.

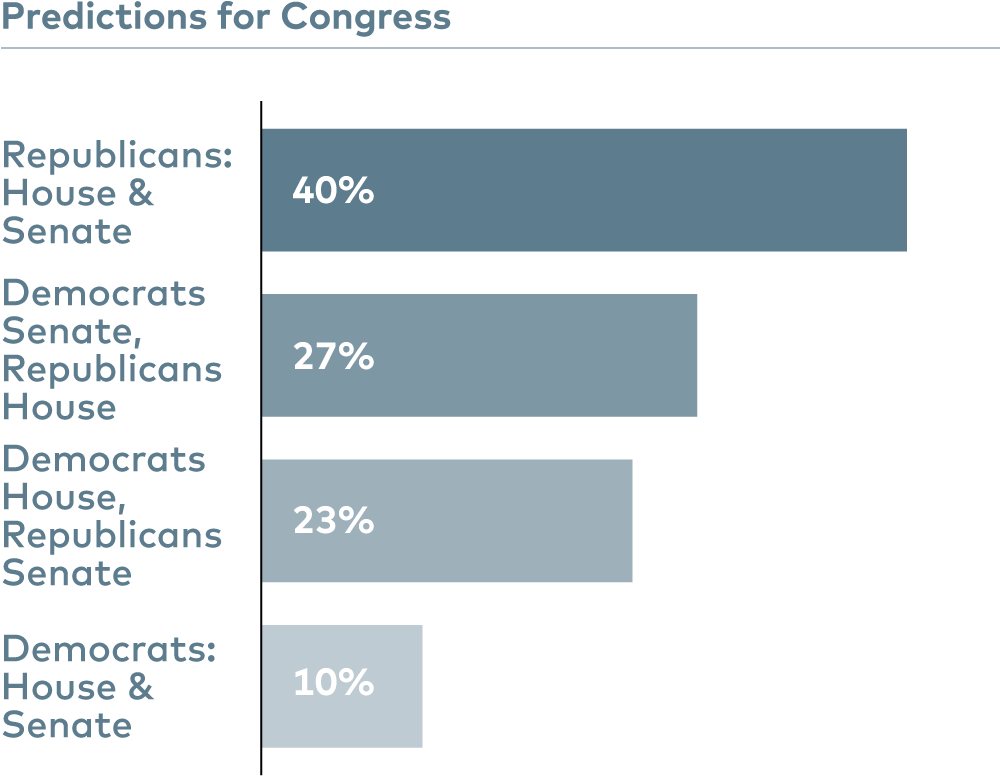

MIDTERMS

Democrats aren’t expected to keep both the House of Representatives and Senate, and if Congress flips completely as nearly half predict, the only health policy lever will be Executive Actions for the next two years. So we can expect that even less than the “nearly nothing” of recent history will get accomplished.

FULL SURVEY RESULTS

More than 250 respondents from health tech startups, large employers, insurance companies, healthcare providers, academics, the government, investors and professional service providers conducted the survey between March 17, 2022, and March 25, 2022. If you would like to view the results of our previous surveys, you can find them here:

2021 Healthcare Prognosis

2020 Healthcare Prognosis

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

1

Will “Test to Treat” (President Biden's initiative to ensure rapid "on the spot" access to lifesaving Covid-19 treatments) be successful?

| 5% | Yes, all good |

| 14% | Yes, but antiviral medications will be overused |

| 46% | Yes, but there will be logistical hurdles |

| 35% | No, it’s not that simple |

2

Will variant-specific vaccines/boosters be required?

| 60% | Yes |

| 40% | No |

3

What are the chances we see a new variant that is both highly contagious and severe in 2022?

| 7% | Almost certain |

| 20% | Very likely |

| 45% | Could go either way |

| 26% | Unlikely |

| 2% | No way |

4

How often will we be advised to get boosters?

| 10% | Twice a year |

| 34% | Once a year |

| 38% | Annually, plus additional boosters for any dangerous variants that emerge |

| 15% | Annually and it will be one shot that protects against both Covid-19 and the flu |

| 3% | Less than annually |

5

Total U.S. deaths in 2022 from Covid-19 will be... (60,000 reported in January):

| 28% | <250,000 |

| 52% | 250,000 - 500,000 |

| 14% | 500,000 - 750,000 |

| 3% | 750,000 - 1,000,000 |

| 3% | >1,000,000 |

6

How will your company plan to use offices?

| 7% | We will resume using the office full time, just like pre-covid |

| 13% | We will require people to work in offices the majority of time |

| 22% | We will require people to use offices, but only on certain days |

| 40% | We will encourage people to use offices, but leave it to employees to determine their schedules |

| 18% | We have become geographically decentralized and are going to remain virtual |

7

Choose your top five potential 2022 IPOs based on their long-term promise (we excluded all Venrock portfolio companies):

| 12% | Alto Pharmacy |

| 13% | Capsule |

| 18% | Cedar |

| 25% | Cityblock Health |

| 21% | Color |

| 8% | Forward |

| 9% | Galileo |

| 30% | Hinge Health |

| 21% | Komodo Health |

| 19% | Maven Clinic |

| 16% | Olive |

| 32% | Omada Health |

| 23% | Ro |

| 33% | VillageMD |

| 17% | There will be no 2022 IPOs |

8

Which of these fallen angels would you bet on for a 5x increase in stock price (current market cap and % decrease from high as of March 15, 2022 market close)? (select all that apply)

| 19% | 23andMe [ME] - (Market Cap $1.5B; -80%) |

| 20% | Accolade [ACCD] - (Market Cap $0.9B; -76%) |

| 10% | Alignment Healthcare [ALHC] - (Market Cap $1.6B; -68%) |

| 13% | American Well [AMWL] - (Market Cap $0.9B; -92%) |

| 5% | Babylon Health [BBLN] - (Market Cap $1.9B; -61%) |

| 18% | Bright Health [BHG] - (Market Cap $1.3B; -88%) |

| 5% | Cano Health [CANO] - (Market Cap $2.9B; -62%) |

| 8% | Clover Health [CLOV] - (Market Cap $1.4B; -87%) |

| 9% | Hims & Hers Health [HIMS] - (Market Cap $0.9B; -82%) |

| 30% | Oak Street Health [OSH] - (Market Cap $4.7B; -70%) |

| 32% | One Medical [ONEM] - (Market Cap $1.5B; -86%) |

| 18% | Oscar Health [OSCR] - (Market Cap $1.6B; -80%) |

| 11% | Signify Health [SGFY] - (Market Cap $2.8B; -59%) |

| 3% | InnovAge [INNV] - (Market Cap $0.7B; -79%) |

| 11% | Talkspace [TALK] - (Market Cap $0.2B; -88%) |

| 34% | Teladoc Health [TDOC] - (Market Cap $8.7B; -81%) |

9

While SPAC performance has been horrific, do you think the closure of the IPO window will induce higher quality companies to choose SPACs as a route to liquidity in 2022?

| 25% | Yes |

| 75% | No |

10

The next two years will likely bring increased consolidation among venture-backed startups in health tech. Who will be the most active acquirer?

| 25% | United Healthcare / Optum |

| 5% | Other pure play payors (e.g. Elevance (FKA Anthem), Cigna, Humana) |

| 9% | CVS, Walgreens |

| 19% | Big tech (e.g. Apple, Microsoft, Google, Amazon) |

| 21% | Lots of little companies merging |

| 21% | Private equity |

11

Private funding of health tech companies was $8.2B in 2019, $14.9B in 2020 and $29.1B in 2021. In 2022, it will be:

| 14% | <$15B |

| 34% | $15B - $20B |

| 23% | $20B - $25B |

| 19% | $25B - $30B |

| 10% | >$30B |

12

Last year 65% of you said President Biden wouldn’t be able to get a bill through the Senate that would tackle high drug prices, but in his State of the Union speech he committed to lowering drug prices, including a max price for insulin of $35/month. Will his administration be successful in their endeavor to control costs?

| 3% | Yes, meaningfully |

| 64% | Only a little, with WAY more talk than action |

| 3% | Yes, voluntarily by pharma |

| 30% | No, nothing will happen |

13

The 2022 midterm election will result in the following:

| 10% | Democrats keep both the House and Senate |

| 40% | Republicans control both the House and Senate |

| 27% | Democrats lose the House and hold Senate |

| 23% | Democrats hold the House and lose Senate |

14

Will Sunny Balwani of Theranos be found guilty?

| 11% | Yes, he will be found guilty, but serve no jail time |

| 71% | Yes, he will be found guilty with a little jail time |

| 16% | Yes, he will be found guilty with lots of jail time |

| 2% | No, he will be found not guilty |

15

Will Elizabeth Holmes see jail time?

| 28% | Yes, they will throw the book at her for >5 years (sentencing guidelines: 80 years) |

| 70% | Yes, but not much (<18 months) |

| 2% | No |

16

For Chamath Palihapitiya, the Clover lawsuit means…(check all that apply)

| 30% | Bad news for Clover, for his bank account, and for his reputation |

| 24% | It is not as big of problem as his insider trading shareholder lawsuit at Virgin Galactic |

| 39% | It will be harder for him to retain his crown as “SPAC King” and raise future SPACs |

| 32% | Nothing. It doesn’t matter and it will be settled and forgotten |

17

Will Ukraine be an independent country EOY 2022?

| 37% | Yes, it will be an independent country with most of its 2021 landmass |

| 47% | Yes, it will be an independent country, but as a much smaller nation |

| 16% | No, it will not be an independent country |

18

Will Vladimir Putin still rule Russia EOY 2022?

| 86% | Yes |

| 14% | No |

19

How many Ukrainian refugees will be in Europe by EOY 2022? (>3 million as of March 16, 2022)

| 28% | 3-5 million |

| 60% | 5-10 million |

| 12% | > 10 million |

20

Which category best describes your employer?

| 4% | Academia |

| 2% | Government |

| 30% | Investor |

| 27% | Health tech provider |

| 9% | Healthcare provider |

| 5% | Large employer |

| 13% | Professional services |

| 10% | Other |